10 Essential Tips for Beginners in Points & Miles

10 Essential Tips for Beginners in Points & Miles

Whether you're just starting your credit hacking journey or already mastering the art of stacking welcome bonuses, this guide has something for you. Credit hacking is a game-changer when it comes to making the most of your everyday spending. By strategically using credit cards, you can earn free flights, luxury hotel stays, and even business-class international travel—all without spending extra money. If you’re new to points and miles, here are the 10 most important lessons to help you start strong.

1️⃣ Always Be Earning (ABE) – Every Dollar Counts

If you’re not earning points or miles on every purchase, you’re leaving money on the table. Every swipe of your card should be earning rewards, whether it’s a simple grocery run or booking a family vacation.

The key is to always have a credit card that’s working toward a welcome bonus or maximizing rewards in key spending categories like dining, travel, gas, and groceries. If you’re using a debit card or a basic credit card that only earns 1 point per dollar, it’s time to upgrade your strategy and start earning 10-20X more per dollar spent.

2️⃣ The Power of Welcome Bonuses – The Fastest Way to Earn Points

Most people think earning travel rewards happens slowly over time—but that’s not true! The biggest points and miles come from welcome bonuses, not everyday spending.

A typical rewards credit card earns 1-3 points per dollar, but a single welcome bonus can be worth 60,000–150,000 points in one shot. This can be worth $750 to $2,000 in free travel if used correctly.

To get these bonuses, you’ll need to hit the minimum spend requirement, which is usually something like “spend $4,000 in 3 months.” You should only apply for new cards when you know you can meet the requirement using your normal expenses, not by spending extra money.

Redeemed my points for a business class seat from HNL ✈️ NRT on my recent trip to Japan!

3️⃣ Earn in Flexible Points, Not Just Airline Miles

One of the biggest mistakes beginners make is collecting points in a single airline or hotel program instead of earning flexible points that can be used across multiple travel partners.

Programs like Chase Ultimate Rewards, Amex Membership Rewards, Capital One Miles, and Citi ThankYou Points allow you to transfer your points to different airlines and hotels, giving you more booking options and better redemption rates.

For example, instead of being locked into only earning Delta SkyMiles or United MileagePlus, you can transfer Chase or Amex points to the airline offering the best award deal at the time you book. Flexibility is key to getting maximum value from your points. With Southwest Airlines removing free bags and Wanna Get Away fares, it’s now even more beneficial to earn transferable points rather than being stuck with a ton of Southwest miles!

4️⃣ The 5/24 Rule is Real – Plan Your Applications Carefully

Chase has some of the best travel credit cards, but they have a strict rule: If you’ve opened 5 or more personal credit cards in the last 24 months, they will automatically deny your application for a new card—no matter your credit score.

Since Chase cards are some of the most valuable for beginners (like the Chase Sapphire Preferred or Chase Ink Business Preferred), you should prioritize them before opening too many cards with other banks.

This rule is why it’s important to be strategic about your applications. Don’t rush into getting cards randomly—instead, follow a plan to maximize your approvals.

5️⃣ Never Carry a Balance – Pay in Full Every Month

Points and miles are only valuable if you’re not paying interest on your credit cards. If you carry a balance and pay interest, the costs will quickly outweigh any rewards you earn.

To make sure you never pay interest, always pay your statement balance in full every month. The best way to do this is to set up autopay for the full amount, so you never risk missing a payment.

Credit card companies make money from people who carry balances—but we’re here to play the game differently. Earn the rewards, but never pay them a dime in interest!

6️⃣ Learn How to Redeem Wisely (Cash Back vs. Travel)

Not all redemptions offer the same value. Many beginners make the mistake of cashing out their points for gift cards or statement credits, but this often cuts their value in half.

For example, 60,000 Chase points redeemed for cash back will only give you $600. But if you transfer them to a travel partner like United Airlines or Hyatt, those same points could be worth $1,200 to $2,000 in flights or hotels.

The best redemptions are usually airline miles for flights, hotel points for stays, and premium travel experiences—not low-value options like gift cards or merchandise.

Our view from the Prince Park Tokyo tower, booked with Chase points.

7️⃣ Don’t Get Stuck in One Loyalty Program – Stay Flexible

Loyalty programs are designed to keep you locked in, but true travel hackers know that flexibility is key.

Instead of being loyal to one airline or hotel brand, be open to using multiple programs and earning transferable bank points. Airlines and hotels change their award pricing all the time, so sticking to just one brand could mean overpaying when better deals are available elsewhere.

For example, instead of always using Delta SkyMiles, you might find that transferring Amex points to Air France Flying Blue gets you the same Delta flight for fewer points. Keeping your options open will help you get the best deals every time.

8️⃣ Use Shopping Portals & Dining Programs for Extra Points

Earning points isn’t just about credit card spending—there are ways to boost your earnings without spending extra money.

Many airlines and credit card programs have shopping portals where you can earn extra points just for clicking through their site before making a purchase.

For example:

If you shop at Nike.com, you can go through the United MileagePlus shopping portal and earn 3-5 extra miles per dollar spent.

Dining programs let you register your credit card and earn extra points when dining at participating restaurants.

Stacking these bonus opportunities with your normal spending helps accelerate your points earnings without extra effort.

9️⃣ Think About Business Cards – Even If You Don’t Own a Business

Business credit cards offer huge welcome bonuses and don’t count against Chase’s 5/24 rule. Many people qualify for business cards without even realizing it.

If you’ve ever sold anything on Facebook Marketplace, eBay, Etsy, or done freelance work, you may be eligible. Business cards don’t require a registered business—a sole proprietorship (using your name and Social Security number) often qualifies.

Adding business cards to your strategy can double the points you earn, opening up even more free travel opportunities.

🔟 Be Patient & Stay Consistent – This is a Long Game

Earning points and miles isn’t an overnight win—it’s a long-term strategy.

The people who travel for free in first class didn’t do it by accident. They followed a system—applying for the right cards, meeting the minimum spends, and using their points wisely.

In 12-15 months, you can earn 400,000+ points—enough for business class flights, luxury hotels, or even an entire family vacation for free. The key is to stay consistent and keep moving forward in the strategy.

Want to Take This to the Next Level?

If you’re ready to fast-track your rewards journey, join my FREE Accelerated Client Program, where I will personally guide you through:

✅ Choosing the right credit cards at the right time

✅ Mapping out a strategy based on your travel goals

✅ Maximizing every dollar you spend for free flights and hotels

✅ Keeping track of deadlines, offers, and redemptions

✅ Avoid getting the wrong credit cards & increase your approval odds with banks

Spots are limited! Apply now and let’s start earning your first free vacation together.

Maximizing Your Elite Perks with Alaska & Hawaiian Airlines

Maximizing Your Elite Perks with Alaska & Hawaiian Airlines

Hey folks, it's Scottie, the Credit Hacker, here to break down the latest shake-up in the airline loyalty world. Alaska Airlines and Hawaiian Airlines are teaming up to bring some serious perks to their frequent flyers. Let's dive into what this means for you and how you can maximize these new benefits.

Status Match: Double the Elite Perks

If you're an elite member with HawaiianMiles, you can now match your status with Alaska's Mileage Plan. This means Pualani Gold or Platinum members gain equivalent status in Alaska's program, unlocking access to the extensive Oneworld alliance. For those who racked up miles in both programs last year, Alaska is offering an enhanced status match, considering your combined mileage totals. This could bump you up to higher-tier perks like priority services and better award availability. However, if you're not currently holding elite status, the immediate benefits might be limited unless you've flown with both airlines and can combine your miles.

Redeem Alaska Miles on Hawaiian Flights

Alaska Mileage Plan members can now use their miles to book flights operated by Hawaiian Airlines. This adds more flexibility to Alaska's program, which already includes redemptions on partner airlines within the Oneworld alliance. Keep an eye on award availability, though; new redemption options can lead to increased demand, potentially making it trickier to snag those coveted seats.

Elite Benefits Across Airlines

Alaska's elite members now enjoy select perks when flying with Hawaiian Airlines. These include priority check-in and boarding, complimentary baggage, preferred seating at booking, and access to Extra Comfort seats at check-in when available. No need for a separate HawaiianMiles account—just use your Mileage Plan number when booking to enjoy these benefits. Note that these perks apply specifically to flights operated by Hawaiian Airlines and don't extend to Oneworld partners.

Reciprocal Mileage Earning

You can now earn miles in either Mileage Plan or HawaiianMiles, regardless of which airline you're flying. Just make sure to enter your preferred frequent flyer number into your reservation to ensure the miles land in the right account. It's still unclear how this will affect mileage accrual rates over time, especially with the potential full merger of HawaiianMiles into Mileage Plan later this year. Stay tuned for updates on how this might impact your earning potential.

Credit Card Changes

With these loyalty programs merging, there could be changes to co-branded credit cards. Currently, Bank of America issues Alaska Airlines Visa credit cards, while Barclays handles the Hawaiian Airlines Mastercard. As the programs integrate, it's possible that Barclays may stop offering new Hawaiian Airlines cards, and Bank of America could become the sole issuer of co-branded cards.

What's Next?

These changes are paving the way for a single, unified loyalty program expected to launch later this year. While the exact details are still under wraps, the goal is to deliver some of the most generous benefits in the industry. As always, I'll keep you updated on the latest developments and how to hack these new perks to your advantage.

Stay savvy, travelers! ALOHA!

3 Best Ways to Redeem Points in Hawaii

3 Easy Ways to Redeem Points in Hawaii

I was recently interviewed by Julia Menez from Geobreeze Travel to discuss credit and travel hacks to Hawaii. Click here to listen to the Podcast.

My Credit & Travel Hacking Journey

I was born and raised here in Hawaii and grew up around the travel business. My grandfather & father were in the travel business, both owning a travel booking service and tour bus company.

I started to travel and credit hack in early 2016 because I was eager to find a cheaper & more efficient way to travel, while still saving up for financial investments. So I got my first credit card, the Barclay Arrival+ card. The 80,000 points sign-up bonus is what attracted me to the card, but I later realized that after redeeming the points earned from the sign-up bonus, points were hard to earn afterward and that Barclay’s points weren’t valuable, each point only worth 1 cent.

Following this discovery, a friend turned me onto the Chase Trifecta, which is the trio of these 3 Chase credit cards the CHASE SAPPHIRE PREFERRED, CHASE FREEDOM UNLIMITED, & the CHASE FREEDOM FLEX. With these three cards, I built a more sustainable model to earn points and my points are worth more when redeeming them through the Chase travel portal at 1.25-1.5 cents per point.

After mastering the Chase trifecta, I then opened a dozen more credit cards, using my own strategies as well as tips from other travel hackers, while still maintaining a credit score over 800. This is only a short summary of my journey, but I did want to share some deals with you all as a credit hacker and resident of Hawaii.

Look for these Deals when traveling to Hawaii

1.WEST COAST TO HAWAII UNDER $60 or 10,000 points on Southwest Airlines.

In March 2019, Southwest Airlines announced it would begin routes from the west coast to Hawaii. Prior to their arrival, Hawaiian airlines held the majority of the interisland travel and west coast travel, but Southwest Airlines has come in and taken the majority of those routes. Their cheap prices, customer service & unique boarding style have made it the preferred choice of travel to and from the islands.

On low travel seasons, direct flights can be purchased at under 10,000 southwest points. Not enough Southwest points? Apply for the Southwest Rapid Rewards® Plus Credit Card for an extra 40,000 southwest points or transfer your points directly from your Chase account at a 1 to 1 transfer ratio.

2. INTER-ISLAND TRAVEL UNDER $30 or 2,000 Points on Southwest Airlines.

Along with the cheap west coast flights, Southwest started routes in between the islands of Hawaii. Those routes include flights between the Big Island (Hawaii), Maui, Kauai, & Oahu. Prices average between $39-59 (2500 - 5000 points) one way, but on occasion, prices have dropped below $29 (2,000 points ) during off-seasons. Do your research and look for these deals on inter-island flights.

3. LUXURY STAY at the Andaz Maui at Wailea Resort at 30,000 points a night.

Hyatt is regarded as the best hotel transfer with Chase, with The Points Guy valuing one Hyatt point at 1.7 cents (April 2021). This is an incredible redemption rate, but the Andaz Maui at Wailea Resort is part of the Hyatt Collection boasts an even higher value for your points at over 3 cents per Hyatt point. At the time of this article, booking a standard room costs $1097.00 per night. Hyatt’s category point system allows this Category 7 resort to be priced no more than 30,000 Hyatt points a night! If you do the math, that’s 3.65 cents per Hyatt point. To top this amazing deal off, Chase transfers points to Hyatt at a 1:1 ratio. Chase also has a co-branded Hyatt Visa credit card that you can get for a 60,000 point sign-up bonus, a free anniversary night, and other travel benefits.

Updated Nov 2023: As a Category 8 Hyatt, the Andaz Maui at Wailea will cost you 35,000-45,000 World of Hyatt points per night.

There are many other travel deals when traveling to Hawaii, but these 3 will bring the most value to your points. If you would like to get started with your credit/travel journey, you can support our channel by applying for your cards HERE.

How Airline and Hotel Loyalty programs are changing due to COVID-19, coronavirus.

Given the global situation concerning COVID-19 (the coronavirus), frequent travelers have stayed at home and are practicing social distancing instructions in order to prevent further spread of the illness. As we hope for the safe health of others, we're all dreaming of a return to normal travel. While no one can quite predict when that might be, travel companies have made moves to keep their programs active and members engaged. Here's a list by Ramsey Qubein on what to know about travel loyalty program changes, elite status, and qualifications moving forward.

Accor Live Limitless

Accor’s loyalty program is crediting 50 percent of the status nights and points required to requalify for your current status level. This automatically gets you halfway toward the same status for next year.

Aeroplan

Air Canada is pausing the expiration of miles until May 14, which means if you had miles set to expire before then, they now last until mid-May. Altitude members are receiving additional eUpgrade credits in their accounts, which are valid until May 31, 2021.

Best Western Rewards

Best Western was one of the first to extend status for members until January 31, 2022. This means that your current status remains the same unless you earn a higher level this year. Plus, anyone who was downgraded in status based on travels in 2019 will be boosted to their previous level until January 31, 2022, as well.

Cathay Pacific Marco Polo Club

Cathay is automatically adding monthly increments of points between now and April to get travelers closer to status thresholds even when they cannot travel. In addition, those with lounge passes, upgrade certificates, and Gold Companion Card nominations will receive six-month extensions to use them.

Choice Privileges

Any points set to expire have been extended through the end of May 2021.

Delta SkyMiles

If you have upgrade and companion certificates that were supposed to expire this spring, the validity has been extended through the end of the year.

Emirates Skywards

The airline is lowering elite threshold requirements between now and May 2020 by 20 percent.

Etihad Guest

The airline is delivering bonus tier miles on a monthly basis to pad member balances and help them toward annual elite thresholds during the travel slowdown.

Flying Blue

Miles will no longer expire this year, and for those with status expiring this spring, elite status requirements are being lowered by 25 percent.

Hilton Honors

Any points that were scheduled to expire between now and May 31 will be extended.

IHG Rewards Club

IHG was a first mover in making status easier for travelers. Travelers now have lower requirements to earn elite status. For example, Gold Elite status now requires 7,000 qualifying points (instead of 10,000) or seven qualifying nights (instead of 10) this year to earn status. Top-tier Spire Elite status only requires 55,000 qualifying points (instead of 75,000) or 55 nights (instead of 75).

Marriott Bonvoy

If you have free night or Suite Night awards (used for room upgrades on eligible stays) in your account, these will be extended until December 31, 2021. In addition, any points set to previously expire will be extended to the same date.

Qantas Frequent Flyer

Status is being extended for current elite members by 12 months.

Radisson Rewards

Current elite status has been extended through February 2022, and any upcoming points expiration has been extended through the end of August.

Shangri-La Golden Circle

The current elite status is being extended for another year to December 31, 2021.

Virgin Flying Club

Elite status is being extended by six months.

World of Hyatt

Proposed changes to award categories (the designated number of points needed to redeem for a free night’s stay) will not go into effect this month as planned. Instead, it will be postponed to 2021. That’s good news for stays at many luxury hotels, where the free-night points rate was going to increase.

Why haven’t other brands made adjustments yet?

Given the uncertainty of the current situation, some airlines or hotels may be waiting to see the extent of travel disruption before making an announcement. Even currently announced loyalty program adjustments may change again before the end of the year. As we wait for the curve to flatten, be expecting more change to occur to our favorite hotel and airline programs.

Can I get from International Terminal G to Terminal 3 at SFO without going through security?

Can I get from International Terminal G to Terminal 3 at SFO without going through security?

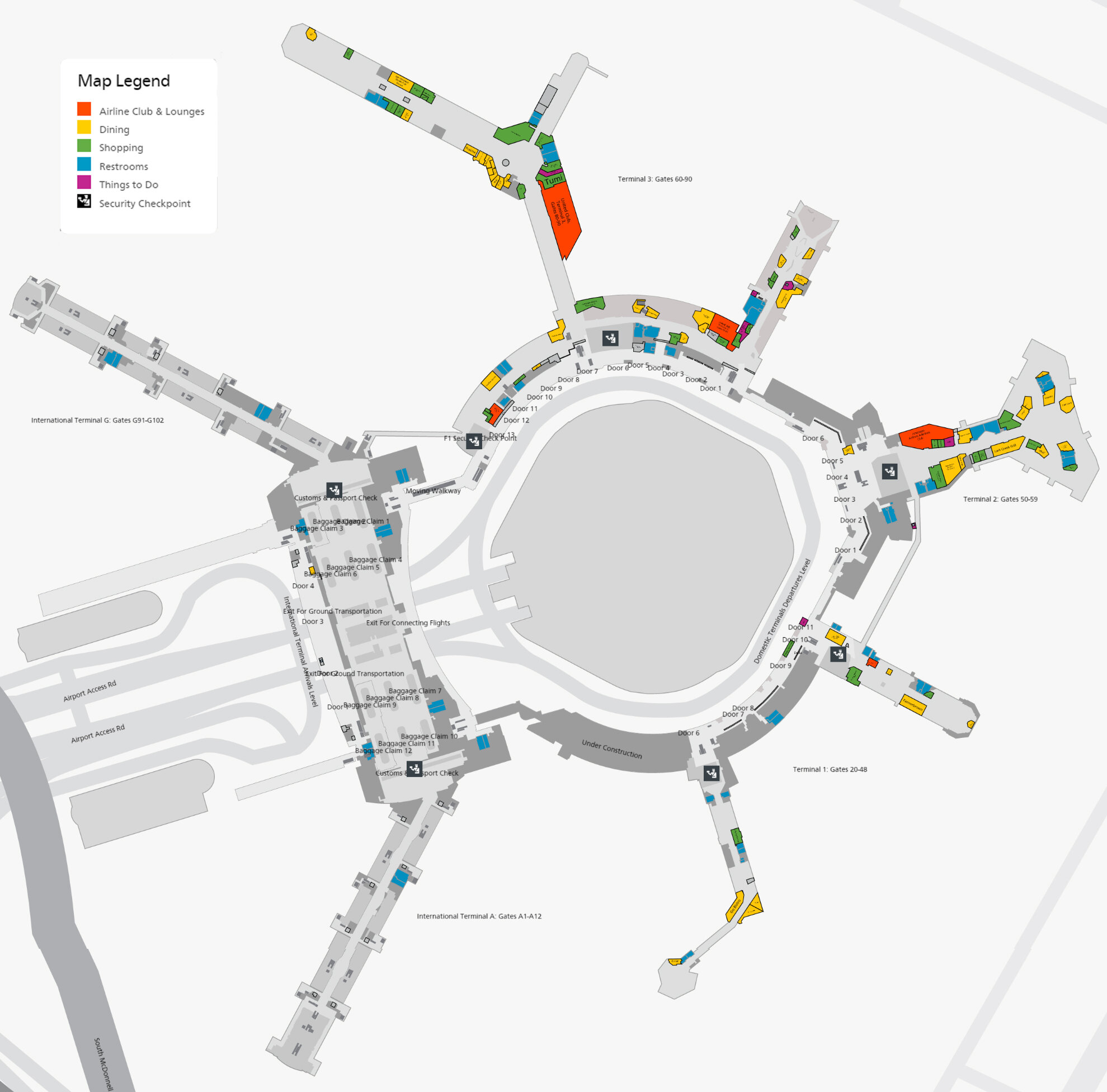

Airside connector between Terminal 3 & International Terminal G

I recently was on a trip to San Francisco, flying from HNL to SFO on Hawaiian airlines and trying to figure out If I could access Terminal 3 without going through security. Our flight attendants and check-in personal said we would have to re-clear security again and online blogs were vague, but we suspected otherwise. Terminal 3 has the American Express Centurion Lounge and 2 restaurants (San Francisco Giants Clubhouse, Yankee Pier) that Priority Pass members & their one other guest can receive $28 of dining credit each.

So can you access TERMINAL 3 from International TERMINAL G?

The answer is: YES, via the Airside Connector

Directions: Upon landing in International Terminal G, proceed toward the end of the terminal, walking along the left side. DO NOT go outside security or else you will have to re-clear security again, instead make a left and you will see the United Polaris Lounge.

Keep walking and you will eventually come to the Terminal 3 airside connector, a small enclosed walkway that connects both terminals. Continue walking through it and follow the signs that lead to Gate F and you eventually find gate F1 which is Terminal 3.

It’s important to not pass any “No Re-entry Signs” or else you will have to re-clear security again.

More info on SFO Terminals

There are 4 main terminal areas that you can commute to without having to go through security again. Those areas are:

International Terminal A (Gates A1-A12)

International Terminal G (Gates G91-G102) connects to Domestic Terminal 3 (Gates 60-90)

Domestic Terminal 1 (Gates 40-48) connects to Domestic Terminal 2 (Gates 50-59)

Domestic Terminal 1 (Gates 20-28)

Below is a list of Airlines operating from their terminals at SFO:

International Terminal A

AeroMexico

Avianca

British Airways

Cathay Pacific

China Airlines

China Eastern

China Southern

El Al

Emirates

Finnair

French Bee

Hawaiian Airlines

Iberia

Icelandair

Interjet

Japan Airlines

JetBlue

KLM

Korean Air

Level

Norwegian

Philippine Airlines

Qantas

Sun Country Airlines

Virgin Atlantic

WestJet

International Terminal G

Aer Lingus

Air Canada

Air China

Air France

Air India

Air New Zealand

Asiana Airlines

Copa Airlines

Eva Air

Fiji Airways

Lufthansa

SAS

Singapore Airlines

Swiss International Air Lines

TAP Air Portugal

Turkish Airlines

United Airlines

Terminal 1

Delta Air Lines

Frontier Airlines

Southwest Airlines

Terminal 2

Alaska Airlines

American Airlines

Terminal 3

United Airlines

Before you plan your trip to SFO, make sure to map out the locations of the lounges you want to visit. The 2 restaurants give you a total of $56 dining credit to use. If you want to take full advantage of this, dine at one restaurant and order take out/have a drink at the other. If you are full, maximize your credit by ordering premium water bottles for your travels.

Alaska Airlines strengthens relationship with American Airlines and will join One World Alliance in 2021

It has been officially announced today that Alaska Airlines will be joining the Oneworld alliance by the summer of 2021. This is BIG NEWS because in light of the recent advancements with Delta airlines. Alaska Airlines rewards offer some of the best point redemptions of any airline rewards program, and this update allows for potential opportunities for earning and redemption through other partner carries. Below is a projected timeline of Alaska Airline’s plans.

Effective immediately:

Redeem Alaska Mileage Plan™ miles on all American Airlines flights (subject to award availability).

Access any of American's nearly 50 Admirals Club locations worldwide with an Alaska Lounge membership.*

Continue to earn and redeem Alaska Mileage Plan miles on our current portfolio of 16 Global Partners.

Starting Spring 2020:

Earn Alaska Mileage Plan miles on any American Airlines flights, domestically and internationally.

Starting Summer 2021:

Earn and redeem Alaska Mileage Plan miles on all oneworld airlines (subject to award availability).

Alaska elites will enjoy privileges, including priority boarding, premium seating, baggage benefits and more when you fly on American Airlines or any oneworld airline.

Access 650 lounges within the oneworld network as an MVP Gold or Gold 75k member.

The Alaska Airlines Visa Signature® card

There are NO major credit card companies that transfer points to Alaska Airlines, but they do have a Visa Signature that comes with a nice sign-up bonus and makes you eligible to purchase Alaska's Famous Companion Fare.

The companion fare entitles the cardholder to purchase one round-trip coach companion fare on Alaska Airlines from $121 (USD) ($99 base fare plus applicable taxes and fees from $22 depending on your flight itinerary) when traveling with another guest on a paid published coach airfare on the same itinerary, booked at the same time.

Ongoing benefits of the Visa Signature® card include:

Alaska's Famous Companion Fare™ from $121 ($99 base fare plus taxes and fees from $22) every year on your account anniversary for Alaska flights booking on alaskaair.com with no blackout dates.

Free checked bag on Alaska flights for you and up to six other guests on the same reservation.

Earn 3 miles for every $1 spent on eligible Alaska Airlines purchases.

Earn 1 mile for every $1 spent on all other purchases.

New: Get 20% back on Alaska Airlines inflight purchases when you use your new card.

New: Receive 50% off Alaska Lounge day passes when you use your new card.

No foreign transaction fees✝, plus chip-enabled for enhanced security when used at chip-enabled terminals.

No mileage cap.

Miles won't expire on your active account.

Low Annual fee of $75†